Colleges

- AAC

- ACC

- Big 12

- Big East

- Big Ten

- Pac-12

- SEC

- Atlantic 10

- Conference USA

- Independents

- Junior College

- Mountain West

- Sun Belt

- MAC

- More

- Navy

- UAB

- Tulsa

- UTSA

- Charlotte

- Florida Atlantic

- Temple

- Rice

- East Carolina

- USF

- SMU

- North Texas

- Tulane

- Memphis

- Miami

- Louisville

- Virginia

- Syracuse

- Wake Forest

- Duke

- Boston College

- Virginia Tech

- Georgia Tech

- Pittsburgh

- North Carolina

- North Carolina State

- Clemson

- Florida State

- Cincinnati

- BYU

- Houston

- Iowa State

- Kansas State

- Kansas

- Texas

- Oklahoma State

- TCU

- Texas Tech

- Baylor

- Oklahoma

- UCF

- West Virginia

- Wisconsin

- Penn State

- Ohio State

- Purdue

- Minnesota

- Iowa

- Nebraska

- Illinois

- Indiana

- Rutgers

- Michigan State

- Maryland

- Michigan

- Northwestern

- Arizona State

- Oregon State

- UCLA

- Colorado

- Stanford

- Oregon

- Arizona

- California

- Washington

- USC

- Utah

- Washington State

- Texas A&M

- Auburn

- Mississippi State

- Kentucky

- South Carolina

- Arkansas

- Florida

- Missouri

- Ole Miss

- Alabama

- LSU

- Georgia

- Vanderbilt

- Tennessee

- Louisiana Tech

- New Mexico State

- Middle Tennessee

- Western Kentucky

- UTEP

- Florida International University

High School

- West

- Midwest

- Northeast

- Southeast

- Other

- Alaska

- Arizona

- California

- Colorado

- Nevada

- New Mexico

- Northern California

- Oregon

- Southern California Preps

- Washington

- Edgy Tim

- Indiana

- Kansas

- Nebraska

- Iowa

- Michigan

- Minnesota

- Missouri

- Oklahoma Varsity

- Texas Basketball

- Texas

- Wisconsin

- Delaware

- Maryland

- New Jersey Basketball

- New Jersey

- New York City Basketball

- Ohio

- Pennsylvania

- Greater Cincinnati

- Virginia

- West Virginia Preps

ADVERTISEMENT

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

500 day streak of Dow closing over 200 day moving average comes to an end at the baby hands of Trump

- Thread starter fried-chicken

- Start date

GDO is up 2.5, savings is down to 2.4, and consumer spending is down to 1.0. On top of that, trade deficits and housing starts are flat. In other words, the money is still here, it isnt going into banks (interest) or savings, its just changing hands.

These arent indicators of recession or inflation, surprisingly. They indicate a movement of money from the stock markets big businesses into small business and possibly commodities.

These arent indicators of recession or inflation, surprisingly. They indicate a movement of money from the stock markets big businesses into small business and possibly commodities.

LolGDO is up 2.5, savings is down to 2.4, and consumer spending is down to 1.0. On top of that, trade deficits and housing starts are flat. In other words, the money is still here, it isnt going into banks (interest) or savings, its just changing hands.

These arent indicators of recession or inflation, surprisingly. They indicate a movement of money from the stock markets big businesses into small business and possibly commodities.

So you basically just read a headline somewhere, posted it, and have no opinion on it?

Look at the trend in the 10-2 bond spread. We're almost negative. What happens each and every time this spread goes negative?

https://fred.stlouisfed.org/series/T10Y2Y

https://fred.stlouisfed.org/series/T10Y2Y

So you basically just read a headline somewhere, posted it, and have no opinion on it?

Do you really think he’s capable of anything more?

Look at the trend in the 10-2 bond spread. We're almost negative. What happens each and every time this spread goes negative?

https://fred.stlouisfed.org/series/T10Y2Y

You surely arent suggesting that all of that money is going into t-bills, are you?

No, I'm saying rates are a bigger risk to the economy right now. Historically, 100% of the time when the 10-2 goes negative we have a recession within a year. We're at .33 right now down from over 1 less than a year ago.You surely arent suggesting that all of that money is going into t-bills, are you?

No, I'm saying rates are a bigger risk to the economy right now. Historically, 100% of the time when the 10-2 goes negative we have a recession within a year. We're at .33 right now down from over 1 less than a year ago.

Then where is the money? It didnt disappear. It hasn't gone into t-bills (yet). Foreign holdings are flat.

You are conflating 2 different issues by pointing out 10-2 and the stock market when by most accounting the money isnt being transferred directly. Yes, there are indicators of recession, but not all indicators are going in that direction. If anything, 10-2 is saying that foreign investment is getting nervous about tariffs and deficits but thats about it.

Also, historically when an economy exceeds 100% debt to GDP it leads to inflation. Now you're suggesting we are going to have deflation?

This is all good information and there are patterns we can look at to make predictions but in reality we are in a position that no country in the history of the world has been in. There are no fundamentals left to make an accurate prediction.

This is all good information and there are patterns we can look at to make predictions but in reality we are in a position that no country in the history of the world has been in. There are no fundamentals left to make an accurate prediction.

Also, historically when an economy exceeds 100% debt to GDP it leads to inflation. Now you're suggesting we are going to have deflation?

This is all good information and there are patterns we can look at to make predictions but in reality we are in a position that no country in the history of the world has been in. There are no fundamentals left to make an accurate prediction.

There are, you've just chosen to view them as unimportant.

Gold is down, BTC is down, but inflation is up. CPI is up but spending is down. Interest rates are up but savings is down.

Make sense of that based on historical evidence.

Make sense of that based on historical evidence.

There are, you've just chosen to view them as unimportant.

Jimmy Carter says hi.

Then where is the money? It didnt disappear. It hasn't gone into t-bills (yet). Foreign holdings are flat.

That money is in the same place it has been for the last few years, sitting in cash reserves and going nowhere.

This recession will lie squarely in the hands of big-business, once again. They refuse to spend their money on new ventures or their employees.

Gold is down, BTC is down, but inflation is up. CPI is up but spending is down. Interest rates are up but savings is down.

Make sense of that based on historical evidence.

The 1920s.

The 1920s.

We were on the gold standard in the 1920s. Completely changes the conversation.

That money is in the same place it has been for the last few years, sitting in cash reserves and going nowhere.

This recession will lie squarely in the hands of big-business, once again. They refuse to spend their money on new ventures or their employees.

My God- I have never seen someone speak on a subject that they are so categorically unqualified to speak on

Read the article and try to learn something. We are headed for 3% growth or more, finally, mostly BECAUSE businesses are investing and spending money. Durable goods orders are at decades long highs and have remained there for more than 14 months.

Wages are increasing, finally.

It’s more likely that we have a recession due to some crazed leftie taking Maxine Water’s que and attempting to kill Trump, than it is due to corporations not spending.

https://www.google.com/amp/s/www.marketwatch.com/amp/story/guid/747CCF84-7628-11E8-BB86-C86DAFB3B4C6

Historically bad price to earning ratio.Explain how we've seen 400% inflation in the stock market while seeing only 25% inflation in CPI since 2009?

The US feels overvalued from a fundamental P/E ratio standpoint to me, but that’s not to say there isn’t money to be made. Could be the new normal. The down action earlier in the year was legit. We’re due for a down year in the US for sure.

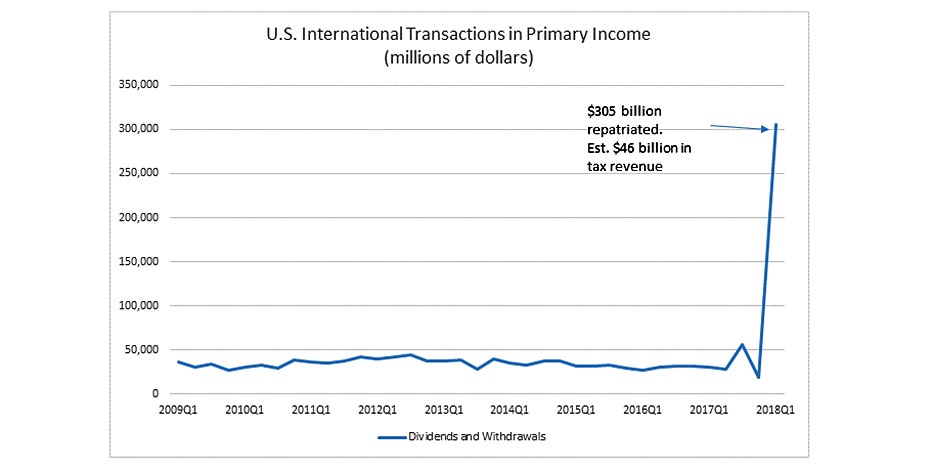

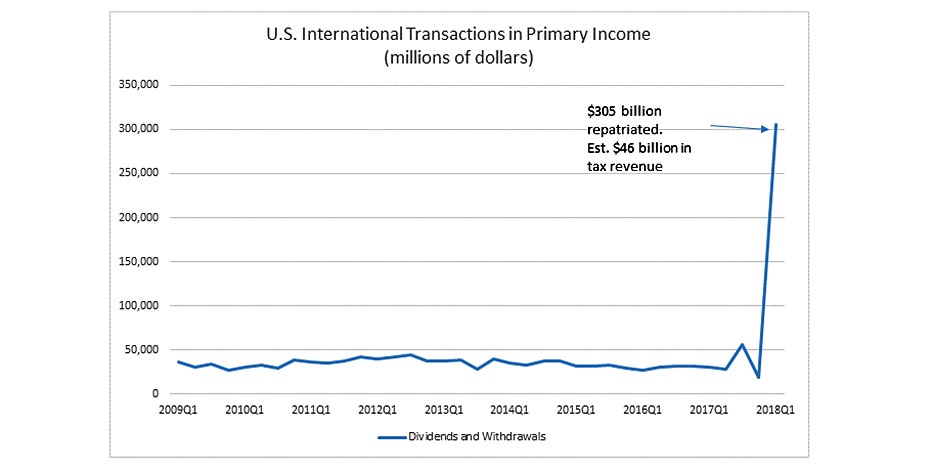

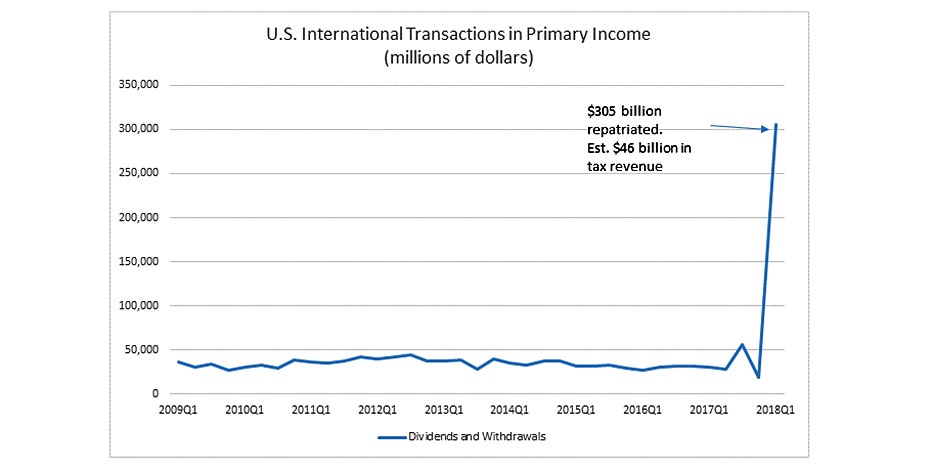

$300B in overseas cash was brought back to the US in Q1 alone. A US record.

Things are terrible!

Things are terrible!

$300B in overseas cash was brought back to the US in Q1 alone. A US record.

Things are terrible!

Wonder where that money is going

Wonder where that money is going

Read the corporate investment story I posted earlier.

That money is in the same place it has been for the last few years, sitting in cash reserves and going nowhere.

This recession will lie squarely in the hands of big-business, once again. They refuse to spend their money on new ventures or their employees.

Cash reserves are down 300 billion since the first of the year according to FRED.

Cash asset holdings 1985: 209 billion

Cash asset holdings 2008: 320 billion

Cash asset holdings 2010: 1.2 trillion

Cash asset holdings 2016: 2.9 trillion

Cash asset holdings 2018: 2.2 trillion

50% rise from Reagan to Obama (23 years)

900% rise during Obama's term (8 years)

25% drop during Trump's term (2 years)

Thoughts?

Cash asset holdings 2008: 320 billion

Cash asset holdings 2010: 1.2 trillion

Cash asset holdings 2016: 2.9 trillion

Cash asset holdings 2018: 2.2 trillion

50% rise from Reagan to Obama (23 years)

900% rise during Obama's term (8 years)

25% drop during Trump's term (2 years)

Thoughts?

So, wages and investing are just starting to move upwards? After all of the obscene amounts of money that have been dumped into the economy in the last 10 years? After a huge tax benefit that essentially dumped another huge amount of cash into the economy?

They better be going up. It is about damn time they went up. But, we're still in the "we'll see" phase.

They better be going up. It is about damn time they went up. But, we're still in the "we'll see" phase.

So, wages and investing are just starting to move upwards? After all of the obscene amounts of money that have been dumped into the economy in the last 10 years? After a huge tax benefit that essentially dumped another huge amount of cash into the economy?

They better be going up. It is about damn time they went up. But, we're still in the "we'll see" phase.

Agreed. Tax breaks get people to spend money. A 900% increase in cash surplus and never broke 3% GDO? That makes no sense, which is my point. There are no market fundamentals left to be able to predict anything

It makes sense to me... financials for investors are more important than paying employees or coming up with new ideas.Agreed. Tax breaks get people to spend money. A 900% increase in cash surplus and never broke 3% GDO? That makes no sense, which is my point. There are no market fundamentals left to be able to predict anything

Is Peak Capitalism a thing?

The S&P is less than 1% from making a new all-time record high. It is up 24% on a Quarter to Quarter basis from last year.

https://www.cnbc.com/2018/08/07/us-markets-earnings-data-and-trade-concerns-in-focus.html

Counseling is available for FC and others with TDS.

https://www.cnbc.com/2018/08/07/us-markets-earnings-data-and-trade-concerns-in-focus.html

Counseling is available for FC and others with TDS.

https://www.marketwatch.com/story/t...ion-the-godfather-won-best-picture-2018-08-06

Talk about the dog days! The Dow Jones Industrial Average registered a dubious distinction at the closing bell Monday, despite its attempt at a rally.

The blue-chip benchmark failed to move 10% above the closing low hit earlier in the year, and with that has now spent the longest period in correction territory, 124 trading sessions, since the 130-session stint the benchmark spent in correction back in 1973, according to Dow Jones Market Data.

Great bump.

Talk about the dog days! The Dow Jones Industrial Average registered a dubious distinction at the closing bell Monday, despite its attempt at a rally.

The blue-chip benchmark failed to move 10% above the closing low hit earlier in the year, and with that has now spent the longest period in correction territory, 124 trading sessions, since the 130-session stint the benchmark spent in correction back in 1973, according to Dow Jones Market Data.

Great bump.

I don't write for market watchDow up 165 on the day and FC trying to grasp at straws

![Laughing [laughing] [laughing]](http://l.yimg.com/j/assets/img/emoticons/classic/laugh.r191677.gif)

$SPY chart looks aight to me. Don't fight the tape. Higher high than the Feb & Mar bounce ups in July and the continuation we didn't get in Jun.

Similar threads

- Replies

- 38

- Views

- 776

- Replies

- 16

- Views

- 512

- Replies

- 16

- Views

- 941

- Replies

- 12

- Views

- 781

- Replies

- 20

- Views

- 627

ADVERTISEMENT

Latest posts

-

-

OT: Orlando Magic Mega Thread - Playoffs vs. Cavs 🏀

- Latest: hemightbejeremy

-

ADVERTISEMENT