Colleges

- AAC

- ACC

- Big 12

- Big East

- Big Ten

- Pac-12

- SEC

- Atlantic 10

- Conference USA

- Independents

- Junior College

- Mountain West

- Sun Belt

- MAC

- More

- Navy

- UAB

- Tulsa

- UTSA

- Charlotte

- Florida Atlantic

- Temple

- Rice

- East Carolina

- USF

- SMU

- North Texas

- Tulane

- Memphis

- Miami

- Louisville

- Virginia

- Syracuse

- Wake Forest

- Duke

- Boston College

- Virginia Tech

- Georgia Tech

- Pittsburgh

- North Carolina

- North Carolina State

- Clemson

- Florida State

- Cincinnati

- BYU

- Houston

- Iowa State

- Kansas State

- Kansas

- Texas

- Oklahoma State

- TCU

- Texas Tech

- Baylor

- Oklahoma

- UCF

- West Virginia

- Wisconsin

- Penn State

- Ohio State

- Purdue

- Minnesota

- Iowa

- Nebraska

- Illinois

- Indiana

- Rutgers

- Michigan State

- Maryland

- Michigan

- Northwestern

- Arizona State

- Oregon State

- UCLA

- Colorado

- Stanford

- Oregon

- Arizona

- California

- Washington

- USC

- Utah

- Washington State

- Texas A&M

- Auburn

- Mississippi State

- Kentucky

- South Carolina

- Arkansas

- Florida

- Missouri

- Ole Miss

- Alabama

- LSU

- Georgia

- Vanderbilt

- Tennessee

- Louisiana Tech

- New Mexico State

- Middle Tennessee

- Western Kentucky

- UTEP

- Florida International University

High School

- West

- Midwest

- Northeast

- Southeast

- Other

- Alaska

- Arizona

- California

- Colorado

- Nevada

- New Mexico

- Northern California

- Oregon

- Southern California Preps

- Washington

- Edgy Tim

- Indiana

- Kansas

- Nebraska

- Iowa

- Michigan

- Minnesota

- Missouri

- Oklahoma Varsity

- Texas Basketball

- Texas

- Wisconsin

- Delaware

- Maryland

- New Jersey Basketball

- New Jersey

- New York City Basketball

- Ohio

- Pennsylvania

- Greater Cincinnati

- Virginia

- West Virginia Preps

ADVERTISEMENT

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

GME

- Thread starter NinjaKnight

- Start date

Bought 100 shares at 88 yesterday morning but sold at 100 because it was too volitile for me while I was trying to work. Big regrets.

Bought 100 shares at 88 yesterday morning but sold at 100 because it was too volitile for me while I was trying to work. Big regrets.

It's going to $1k

BB is next

BB isn't shorted as much to my knowledge. 139% is a unique situation. They probably won't make that mistake again.It's going to $1k

BB is next

That dude that started this with his 50k buy might have made over 3 million bucks on this deal. LMAO!

What caused the unreal spike?Bought 100 shares at 88 yesterday morning but sold at 100 because it was too volitile for me while I was trying to work. Big regrets.

Some dude noticed that that there more shares being shorted than actually exist, so he bought 10,000 shares to create an even bigger shortage. He brought it up on a reddit board and a bunch of people jumped on it as well. Now the hedge funds that were committed have no choice but to pay whatever it takes to cover those commitments.What caused the unreal spike?

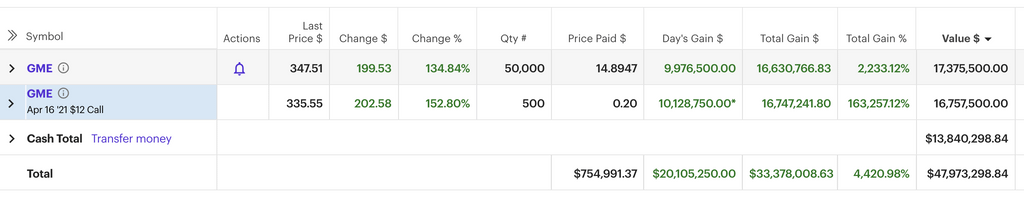

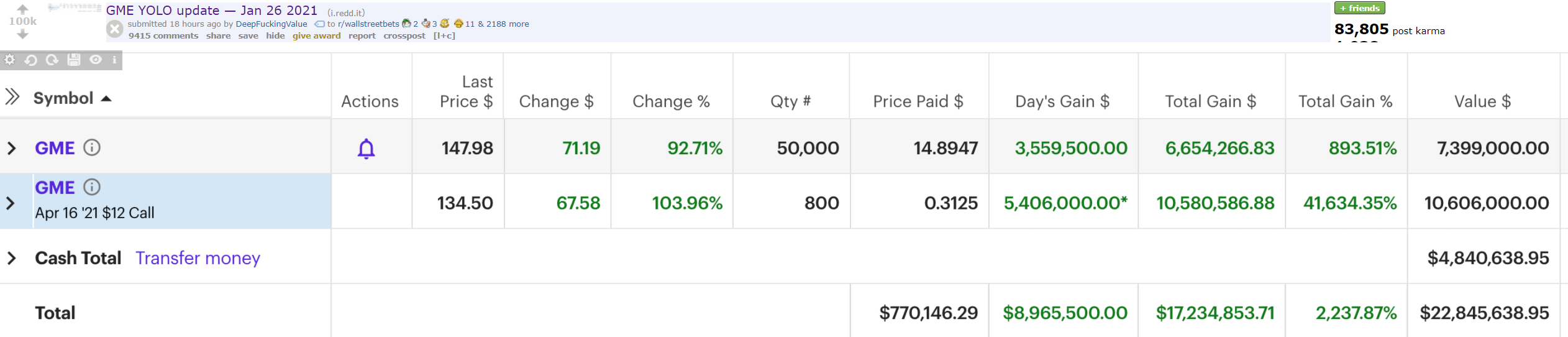

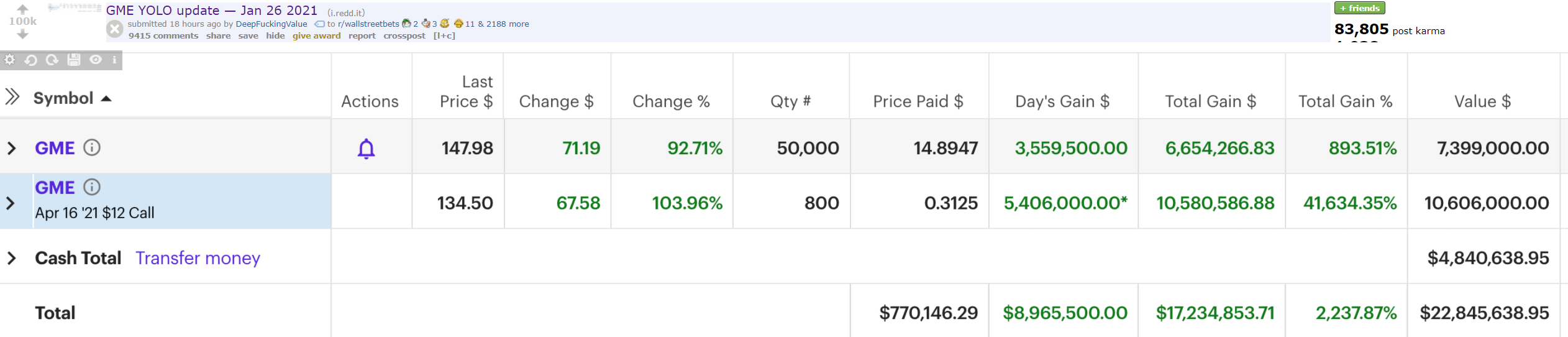

Last I saw yesterday he was over 22 million. He's gotta be over 30 at this point.That dude that started this with his 50k buy might have made over 3 million bucks on this deal. LMAO!

What did he buy in for? I just assumed he got in at 5$Last I saw yesterday he was over 22 million. He's gotta be over 30 at this point.

From his latest update. Honestly it's moronic that he hasn't cashed out yet.

Ah. I heard he put 50 grand in, but he bought 50,000 shares. That is insane!

From his latest update. Honestly it's moronic that he hasn't cashed out yet.

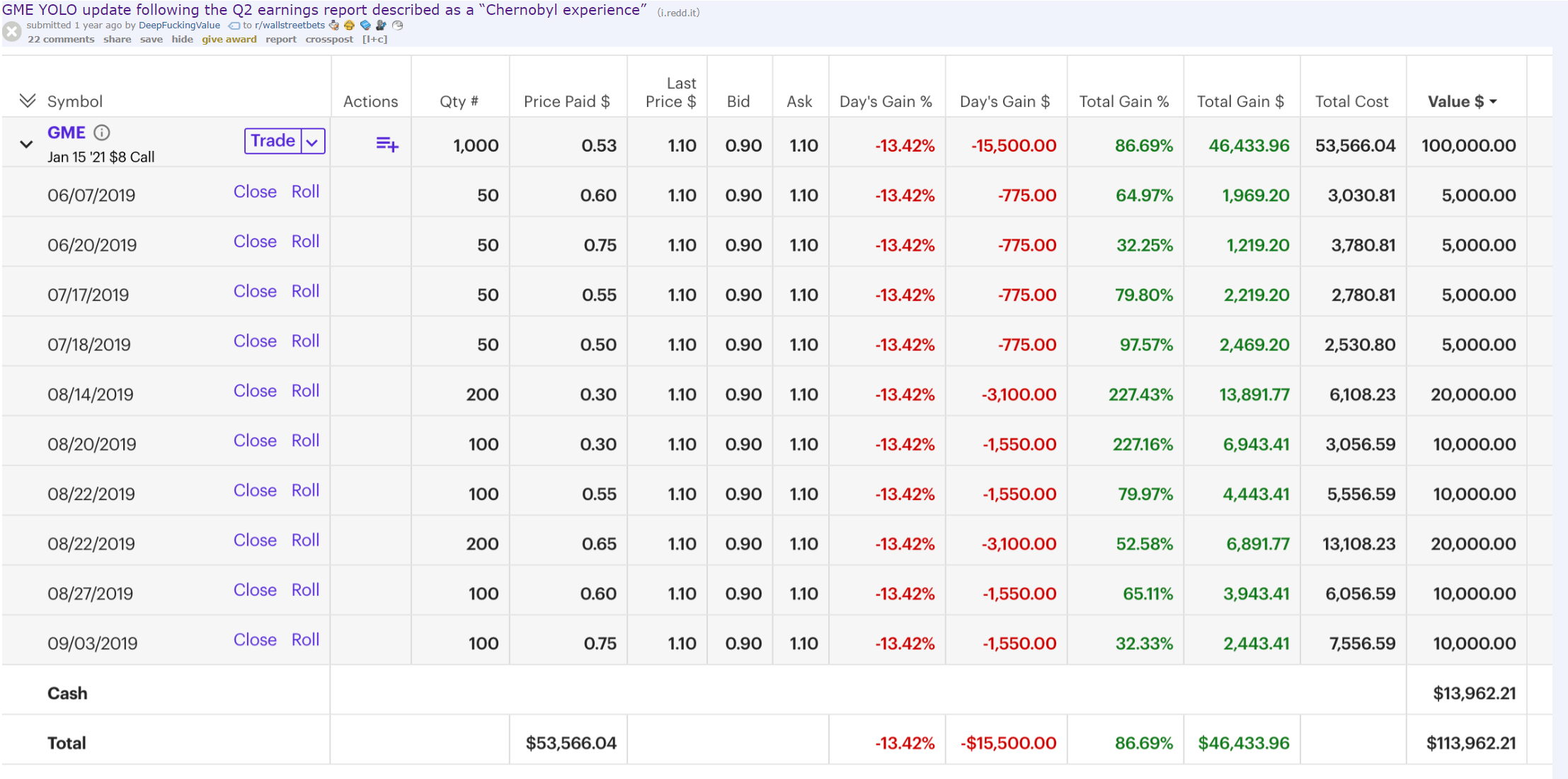

You're right about the 50 grand. Digging in and here's his initial position from back in 2019.Ah. I heard he put 50 grand in, but he bought 50,000 shares. That is insane!

**** that noise. They didn't bailout the owners of GME who they shorted out of wealth over the past year.I see where one hedge fund is already saying they are going to have to be bailed out.

Many reddit posters are about to be very wealthy and they'll be looking for the next move. I would jump into some of these meme stocks if you missed the boat in GME.

$BB

$AMC

$NOK

$BBBY

Just hope one of these hits

$BB

$AMC

$NOK

$BBBY

Just hope one of these hits

I'll bet AMC will be next. Its so satisfying seeing a bunch of nobody traders taking down these a-holes.Many reddit posters are about to be very wealthy and they'll be looking for the next move. I would jump into some of these meme stocks if you missed the boat in GME.

$BB

$AMC

$NOK

$BBBY

Just hope one of these hits

They are cheap. Throw 500 bucks at all of them and hope they go up 1000%I'll bet AMC will be next. Its so satisfying seeing a bunch of nobody traders taking down these a-holes.

Reddit is going to put their newly found 10Billion somewhere and my guess is they'll go back for seconds.

I foolishly bought 500 AMC last March when it crashed during the initial shut downs thinking they'd quickly open back up. Finally almost a year later getting a nice return on that stupid play.I'll bet AMC will be next. Its so satisfying seeing a bunch of nobody traders taking down these a-holes.

Just like gamestop, I'll bet AMC never comes back. Kind of nice to see people being able to make money off of the people trying to take advantage of it.I foolishly bought 500 AMC last March when it crashed during the initial shut downs thinking they'd quickly open back up. Finally almost a year later getting a nice return on that stupid play.

As cool as it is to see a movie in the theaters, it's just as big a hassle. I bought a projector and built a media room (still looking for the right theater seating.) But, short of a popcorn machine we're just don't need to drop $50 that experience anymore.Just like gamestop, I'll bet AMC never comes back. Kind of nice to see people being able to make money off of the people trying to take advantage of it.

I saw one theater was letting you do your own private movie night for a couple hundred bucks. If that's where the industry is at AMC is going to go out like drive ins and blockbuster.

Yep. I know we've had this conversation before, but its worth repeating: it's no coincidence that every major movie production company has signed a contract with a streaming provider. This started happening before the pandemic so the foundation was already being set for a conversion to home streaming. I used to own a video store so this is very familiar to me.As cool as it is to see a movie in the theaters, it's just as big a hassle. I bought a projector and built a media room (still looking for the right theater seating.) But, short of a popcorn machine we're just don't need to drop $50 that experience anymore.

I saw one theater was letting you do your own private movie night for a couple hundred bucks. If that's where the industry is at AMC is going to go out like drive ins and blockbuster.

I am absolutely loving seeing these funds trying to push back against retail investors making money. Chamath Palihapitiya on CNBC talking right now calling out the funds shorting > 100% of shares and how it's blowing up in their face. Inject this into my veins.Ha! There are calls from 2 hedgefund managers to get the SEC to step in and declare this whole thing as being illegal. Sorry guys, reddit is a public forum so this isn't insider trading.

GME is now over 20 billion in market cap. Thats like double what it was 15 years ago and they've closed half their stores. This could trigger a total collapse in the market, which isn't funny but I'm still laughing.I am absolutely loving seeing these funds trying to push back against retail investors making money. Chamath Palihapitiya on CNBC talking right now calling out the funds shorting > 100% of shares and how it's blowing up in their face. Inject this into my veins.

14 days ago GMEs market cap was 155 million, now its at 23 billion. Holy crap that is a huge hit to the shorts, figuratively and literally, lol. I dont know where their positions were exactly, but I see where there were over 125% of shares committed so this could be a 25-30 billion dollar hit. Some were as low as 34 cents.

Up huge in these in only a few hours. Get in on the ground floor here.Many reddit posters are about to be very wealthy and they'll be looking for the next move. I would jump into some of these meme stocks if you missed the boat in GME.

$BB

$AMC

$NOK

$BBBY

Just hope one of these hits

AMC up 400% with 20 times the volume. Its nice to see the hedgefunds losing at their own game. Now they'll cry about the free market because it's costing them billions.Up huge in these in only a few hours. Get in on the ground floor here.

Unbelievable. If its too much risk to short a stock, you shouldn't have done it. Stop whining about the fact that you lost.

Whaaaaaaaaaaaa! We stood to make millions off of this deal, now we are losing billions. Unfair! Unfair!

Oh no, let me get out the worlds smallest violin for these corrupt billionaire wall street pieces of shit doing nothing to add to the greater good of the world.

Bahahahahahaha! God i hope he doesn't get caught in the sell-off. This dude is legend.

Similar threads

- Replies

- 1

- Views

- 190

- Replies

- 5

- Views

- 226

- Replies

- 110

- Views

- 2K

ADVERTISEMENT

ADVERTISEMENT